Current Ratio Less Than 1

Three-phase fault current IL. ISC I L Ratio ISC.

Acid Test Ratio Vs Current Ratio Formula Comparison Excel Template

Standard times for which the CT must be able to carry rated short-time current STC are 025 05 10 20 or 30 seconds.

. How to Improve Your Debt-to-Income Ratio. All assessments were required for the 2020-2021 school year and results will be reported. Step-down transformer steps voltage down and current up.

If inventory turns into cash much more rapidly than the accounts payable become due then the firms current ratio can comfortably remain less than one. Speed multiplication gear train steps torque down and speed up. Current ratio 60 million 30 million 20x.

Less than 15 times limits Current. Less than 20 times limits Short time 10 minute measurements 95 th and 99 th percentiles over 1 week period. If Current Assets Current Liabilities then Ratio is less than 10 - a problem situation at hand as the.

To qualify for an FHA loan youll need a front-end ratio of less than 31. A rate of more than 1 suggests financial well-being for the company. Additionally testing timelines were extended for WIDA English language proficiency.

Columbia further reserves the right to require the applicant to provide additional information andor authorization for the release of information about any such matter. Government mortgage loans lenders must follow the requirements for the respective government agency. Similar to the current ratio a company that has a quick ratio of more than one is usually considered less of a financial risk than a company that has a quick ratio of less than one.

For most industrial companies 15 may be an acceptable current ratio. Current ratio is balance-sheet financial performance. Some types of businesses can operate with a current ratio of less than one however.

Interpretation of Current Ratios. To gauge this ability the current ratio considers the current. A CT with a particular short-time current time rating carries a lower current for a longer time in inverse proportion to the square of.

Typical ETF expense ratios are less than 1. If Current Assets Current Liabilities then Ratio is equal to 10 - Current Assets are just enough to pay down the short term obligations. Lets say you invest 100000.

An obstructive defect is indicated by a low forced expiratory volume in one secondforced vital capacity FEV 1 FVC ratio which is defined as less than 70 or below the fifth percentile based. When youre applying for a mortgage improving your debt-to-income ratio can make a difference in how lenders view you. That means that for every 1000 you invest you pay less than 10 a year in expenses.

If the winding ratio is reversed so that the primary coil has fewer turns than the secondary coil the transformer steps up the voltage from the source level to a higher level at the load. Maximum demand current 15 or 30 minute demand not momentary. Liquidity ratios greater than 1 indicate that the company is in good financial health and it is less likely fall into financial difficulties.

The candidate is holding both a place at Columbia and a place in the first-year class of a college other than Columbia after the May 1 deadline. Low values for the current ratio values less than 1 indicate that a firm may have difficulty meeting current obligations. A current ratio of less than 1 indicates that the company may have problems meeting its short-term obligations.

How the ETF expense ratio works. A ratio higher than one means that current assets if they can all be converted to cash are more than sufficient to pay off current obligations. All other things equal higher values of this ratio imply that a firm is more easily able to meet its obligations in the coming year.

If Current Assets Current Liabilities then Ratio is greater than 10 - a desirable situation to be in. Acceptable current ratios vary from industry to industry. The business currently has a current ratio of 2 meaning it can easily settle each dollar on loan or accounts payable twice.

If youre applying for a mortgage many lenders will prefer a front-end DTI of less than 28. However an investor should also take note of a companys operating cash flow in order to get. The current ratio is a liquidity ratio that measures a companys ability to pay short-term and long-term obligations.

Non-occupant borrowers the maximum ratio is lower than 45 for the occupying borrower for manually underwritten loans see B2-2-04 Guarantors Co-Signers or Non-Occupant Borrowers on the Subject Transaction. The 95 participation requirement for assessments was waived thus assessment reporting for 2020-21 may look different than in prior years. Most common examples of liquidity ratios include current ratio acid test ratio also known as quick ratio cash ratio and working capital ratio.

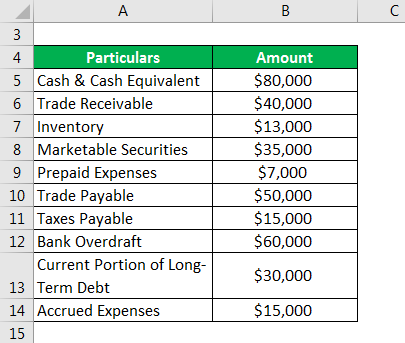

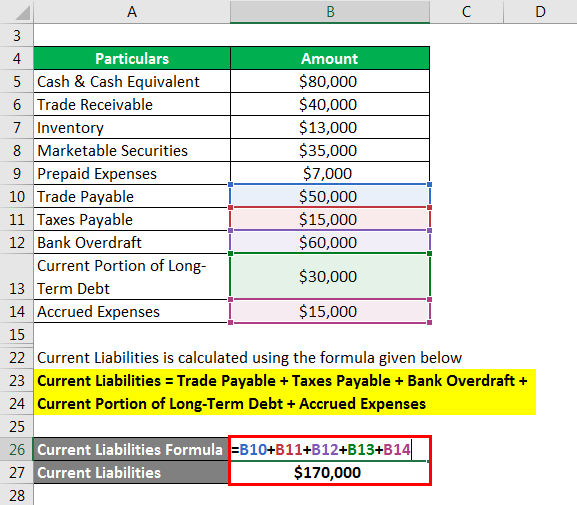

Current Ratio Examples Of Current Ratio With Excel Template

Current Ratio Examples Of Current Ratio With Excel Template

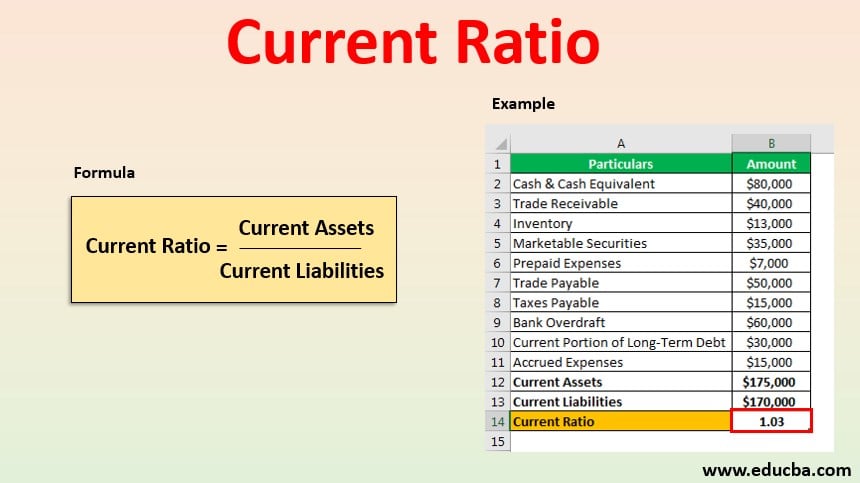

Current Ratio Formula Examples How To Calculate Current Ratio

No comments for "Current Ratio Less Than 1"

Post a Comment